Ira return calculator

Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future. Return on investment calculator.

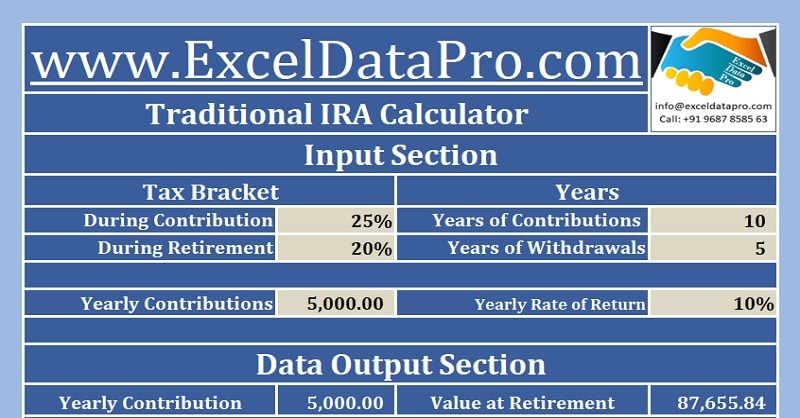

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Traditional IRA contributions.

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

. Balance at Age 65. The 72t Early Distribution Illustration helps you explore your options for taking IRA distributions before you reach 59½ without incurring the IRS 10 early distribution penalty. Consider returning to the Calculator at least annually to.

Throughout the past 140 years the average 10-year stock market return rate has been 92 percent. The Inherited IRA Distribution Calculators results may vary with each use and may change over time due to updates to the Calculator or because of changes in personal circumstances or market conditions. The deduction for Roth IRA losses is an itemized deduction which means you must itemize on your tax return and cannot claim the standard deduction.

How much are you required to withdraw from your inherited retirement accounts. You can use your Roth IRA to invest in a range of assets including stocks and bonds. Free inflation-adjusted IRA calculator to estimate growth tax savings total return and balance at retirement of Traditional Roth IRA SIMPLE and SEP IRAs.

Traditional IRA calculator. A Roth IRA is a smart way to grow your savings for the future. Riskier investments like high-growth stocks have a higher return potential but they also have the potential for greater losses.

You are responsible for the calculation of your Inherited IRA RMD and the accuracy of your tax return. Of course any return you see on a Roth IRA account depends on the investments you put into it but historically these accounts have on average achieved between a 7 and 10 return. These investment accounts offer tax-free income when you retire.

What is the return on my real estate investment. Withdrawals of taxable amounts may be subject to. A 401k account is an easy and effective way to save and earn tax deferred dollars for retirement.

For someone relying entirely on a private employer pension 401k or IRA for their retirement income Hawaii will be rather unfriendly because that income would be subject to. If you are eligible you can make tax deductible contributions to a traditional IRA and accumulate earnings within the IRA tax-free until you are required to begin making withdrawalsusually in the year you turn 72. This is very helpful when purchasing an immediate annuity or comparing pay outs for multiple annuities for a number of years.

What is my risk tolerance. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. What this calculator does.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Analyze Pre-Retirement IRA Distribution Options With Our 72t Calculator 72t early distribution analysis. The IRA Withdrawal Calculator which has been updated to conform to the SECURE Act of 2019 will calculate your current minimum required withdrawal and then forecast your future required withdrawals if you are an IRA owner age 70-12 or older or age 72 if you turn 70-12 after January 1 2020.

What is the value of a call or put option. If youve inherited an IRA andor other types of retirement accounts the IRS may require you to withdraw a minimum amount of money each year also known as a Required Minimum Distribution RMD. Use our IRA calculator to see how much your nest egg will grow by the time you reach retirement.

NerdWallets 401k retirement calculator estimates what your 401k balance will be at. This annuity rate of return calculator will calculate the rate of return from an annuity. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

If you simply want to withdraw all of your inherited money right now and pay taxes you can. For this reason stocks are a worthwhile investment especially over a longer period. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

When you start taking withdrawals you then need to report the appropriate amounts as income on your tax return. Are you contributing to a traditional individual retirement account IRA. On the other hand the SP index has managed a 136 percent annual return.

Stocks tend to perform very well over time but they can also perform poorly sometimes. Know your Zonehaven evacuation zone so that youll be able to act fast during emergencies. What is the value of a bond.

Helps IRA beneficiaries calculate the required minimum distribution RMD amount that must be withdrawn this calendar year from an inherited IRA if applicable. 401K and other retirement plans. The Roth IRA calculator defaults to a 6 rate of return which should be adjusted to reflect the expected annual return of your investments.

However if you were not planning to itemize make sure that the total amount of your itemized deductions is greater than your standard deduction. Our income tax calculator calculates your federal state and local taxes based on several key inputs. If you are already itemizing this is not significant.

What is the value of compound interest. Signing up for the City and countys emergency alert system allows you to quickly get emergency information. Roth IRAs have widely varying rates of return depending on the assets in the account.

Enter the annual percentage return you expect. For a person living off of Social Security and public pension income with small contributions from an IRA or another retirement account Hawaii can be very tax-friendly. Your household income location filing status and number of personal exemptions.

What is the long-term impact of increased investment return. If you had a transfer or rollover to your Schwab retirement accounts a conversion from a traditional IRA to a Roth IRA and back or any correction for security price after year-end please call us at 877-298-8010 so we can recalculate your RMD. If you return the cash to your IRA within 3 years you will not owe the tax payment.

Calculates the rate of return or interest rate from the point that the annuity begins paying out. With an IRA CD you will get a guaranteed return and tax benefits.

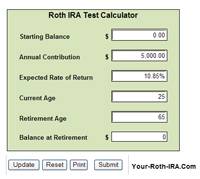

What Is The Best Roth Ira Calculator District Capital Management

What Is The Best Roth Ira Calculator District Capital Management

Traditional Vs Roth Ira Calculator

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Vs Roth Ira Calculator

Ira Calculator See What You Ll Have Saved Dqydj

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculators

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Download Traditional Ira Calculator Excel Template Exceldatapro

Roth Ira Calculator Roth Ira Contribution

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Roth Ira Calculator Excel Template Exceldatapro